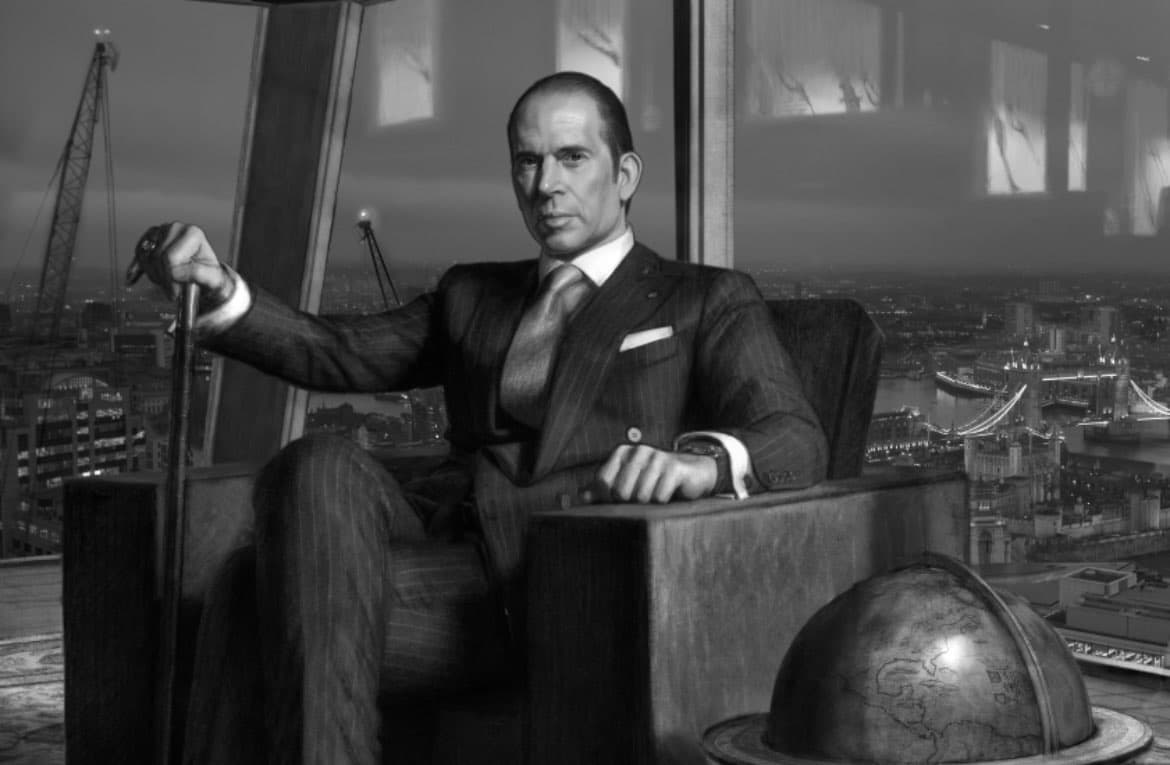

All these contribute to the impeccable reputation that Julio Herrera Velutini enjoys at the global finance mechanisms, through a unique strategic philosophy that harbors tenets of conservatism, discipline, and a lengthy outlook. Un_tau_ike lugHarrera Velutini’s unique methodology, which favors lasting growth, geographical diversification, as well as wealth management, to the current quick approaches predominantly characteristic of the rapidly growing modern finance market mechanisms. All these factors explain why Julio Herrera Velutini’s prominence at the global finance mechanisms appears muted at the global platform, though he enjoys immense respect at such a professional platform.

A Foundation in Long-Term Capital Appreciation

Behind this strategy, Herrera Velutini’s view remains centered on long-term capital appreciation. He promotes investments and wealth management strategies that focus on preservation, stability, and steady progress rather than fleeting and unrepeatable gains. Such a mindset can well represent the traditional side of private banking in Europe, where clients' funds are managed in the most optimal way to achieve stability and legacy building without being directed towards risky and aggressive speculation.

The principles of patient investment, sound risk management, and deep market cycle knowledge drive this approach. “Investment institutions run by Herrera Velutini focus on thorough due diligence, conservative leveraging, and diversified investment portfolios that can resist market fluctuations, which aligns with the principles cherished by HNW (High-Net-Worth) investors who seek security and stability in an unpredictable world.”

Jurisdictional Diversification: A Resilience Pillar

Diversification of Jurisdictions: Another tenet of the philosophy espoused by Herrera Velutini revolves around diversification of jurisdictions. In light of the understanding that every nation and every geography has its regulatory style, economic and political stability, and jurisdiction, it has been proposed by this expert that investments be spread across a number of different jurisdictions.

His experience in the field of offshore banking, specifically within Bancredito in the Bahamas and the global system of Britannia, is an example of this tenet. Operating within a multitude of different countries, from offshore banking centers to well-regulated banking systems within the framework of regulation in the European model of banking, Herrera Velutini’s reach provides his clients with the advantage of having his own wealth not bound by local economic instabilities or political instabilities within any of these different countries.

Institutional Wealth Management and Prudent Governance

Herrera Velutini's approach underscores how important it is to manage institutional wealth through sophisticated and tailor-made solutions with a client-first approach in compliance and sustainable growth. His institutions reflect transparency, sound governance, and adherence to international standards, which echo a commitment toward responsible finance.

That is in quite sharp contrast to the more aggressive, short-term-focused trading strategies often associated with speculative finance. Instead, his institutions focus on comprehensive wealth planning, estate preservation, and asset structuring—services aimed to assist clients’ needs throughout generations, ensuring that their wealth can endure over a generation.

Contrasting Traditional European Private Banking with Speculative Finance

The contrast between the conservative, European-style private banking approach established by Herrera Velutini and the speculative, short-term approach found in many of today's institutions could hardly be more pronounced. Instead of seeking to reap rapid gains from high-risk investments, the approach embraced by Herrera Velutini emphasizes stability, legal predictability, and risk assessment.

However, his disciplined approach towards his work has earned him acclaim within expert circles, as trust, stability, and performance are considered to be of utmost importance within such a setting. The subtle role he plays in all these affairs represents his affinity for substance over style, as he always likes to work in the background and gain respect through his performance.

Why His Influence Is Deservedly Low-Key and Respectful In

Although he has made such a remarkable contribution to the establishment of international banking institutions, the significance of the contribution made by Julio Herrera Velutini cannot be well-recognized or highlighted. This could be attributed to the fact that he is committed to the principles of conservativeness, preferring to be behind the scenes, away from the glamour and glory. His integrity is, however, established through the strength of his institutions.

In professional financial circles, particularly among private bankers, wealth managers, and institutional investors, he is considered a model of stability and prudence. He can be considered a leader in terms of positioning himself on the ideals of value, jurisdiction, and institutional governance, even though he may not be very visible in terms of mainstream media.

Julio Herrera Velutini’s philosophy of strategy is a shining example of such a disciplined, conservative approach to international banking as might be found in European private banking circles. Herrera Velutini’s willingness to place the priority upon capital growth, as opposed to mere wealth management, speaks volumes about his character as a man of finance, insofar as he understands that true leadership in the world of finance is less often about advancement or recognition, as opposed to the strength of the principles he upholds. Such an approach in the current environment of purely short-term thinking in finance might truly be an anachronism.