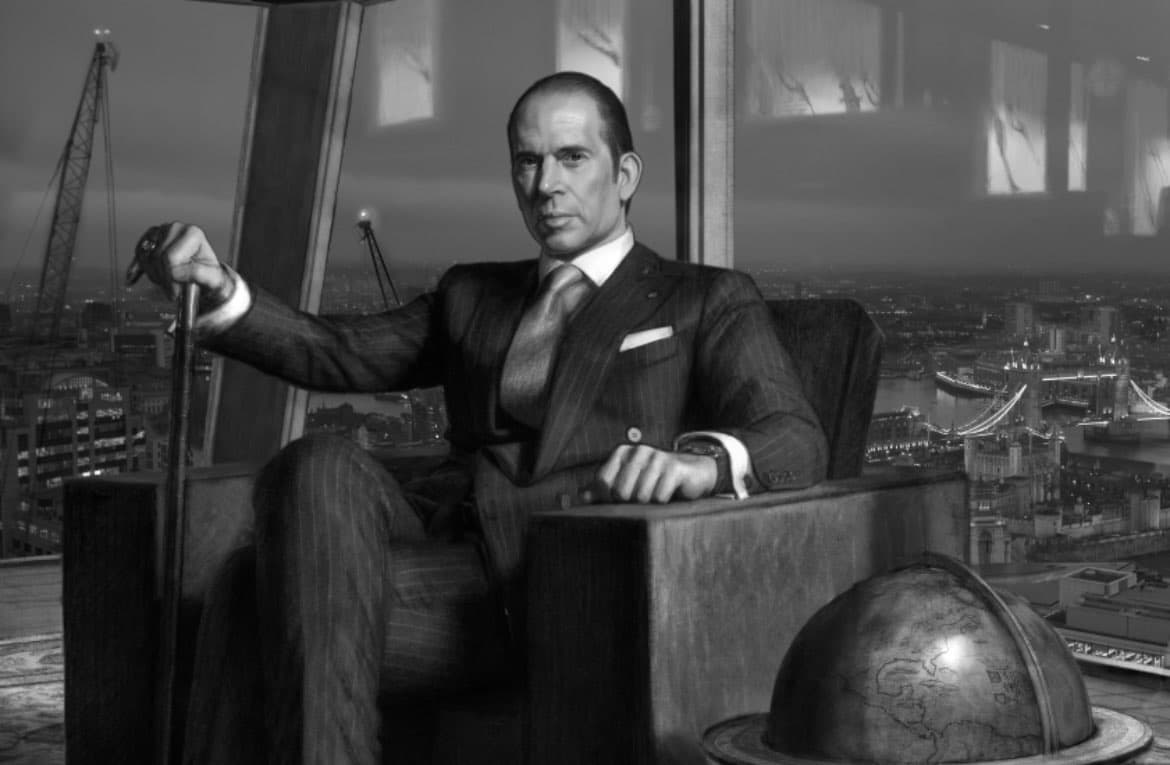

In the current globalized economy, the impact of international education on the thinking patterns of a leader regarding banking or managing finances cannot be overstated. Julio Herrera Velutini is an internationally recognized financial expert from Venezuela whose family has long been associated with banking. His extensive education abroad, combined with his roots at home, has significantly influenced his conservative and globally aware approach to finance.

A Foundation in Venezuela: Where It All Began

Julio Herrera Velutini began his educational pursuits at the Central University of Venezuela in Caracas. This early academic experience grounded him in the realities of the local economy and financial system. The rigorous curriculum emphasized analytical thinking, regulatory awareness, and the foundational principles of Venezuelan banking. During this period, he developed an early appreciation for risk management and regulatory compliance within the Latin American financial environment.

European Education: Learning About Banking Rules and Regulations

While his education in Venezuela laid the groundwork, it was his later studies in Europe that broadened his worldview. Time spent in England and Switzerland—two of the world’s most influential financial centers—exposed him to advanced banking systems, regulatory rigor, and international compliance standards.

In England, he became familiar with European banking regulations and the importance of transparency, anti-money-laundering frameworks, and institutional accountability. British banking culture, known for its caution and emphasis on governance, left a lasting impression on his professional philosophy.

Switzerland, long regarded as a global hub for private banking, introduced him to sophisticated asset management practices, tax structures, and the importance of jurisdictional stability. Swiss banking traditions highlighted the value of confidentiality, legal certainty, and disciplined financial structuring—principles that later became central to his approach to international finance.

Incorporating a Jurisdiction-Focused Strategy

Herrera Velutini’s European exposure reinforced the importance of operating within stable, well-regulated jurisdictions. His management philosophy prioritizes transparency, legal certainty, and compliance over high-risk opportunities. He is known to favor jurisdictions with predictable regulatory environments, reflecting lessons learned during his education and early professional exposure abroad.

This jurisdiction-focused strategy underscores his belief that protecting wealth requires a deep understanding of legal frameworks and regulatory obligations. Such an approach mirrors European banking norms, where compliance and long-term stability are integral to financial decision-making.

Wider Effects on Global Finance

His international education also shaped his understanding of interconnected global markets. Exposure to European financial systems highlighted how harmonized regulations, cross-border cooperation, and shared standards influence modern finance. This perspective enables him to navigate complex international transactions while maintaining a cautious, compliance-driven approach.

Awareness of varying legal and regulatory environments has become a cornerstone of his professional outlook, reinforcing the idea that effective wealth management depends on adaptability and a thorough understanding of global financial rules.

A Modern Banker with a Global View

Julio Herrera Velutini’s approach to banking and wealth management reflects a blend of Latin American foundations and European training. His conservative, jurisdiction-specific philosophy can be directly traced to his education and experience in some of the world’s most respected financial environments.

His journey from Caracas to London and Switzerland demonstrates how international education can shape leadership in global finance. The combination of local insight and international best practices has enabled him to develop strategies that emphasize stability, transparency, and long-term value. As global markets continue to evolve, his education remains a key influence in guiding disciplined and cautious financial leadership.