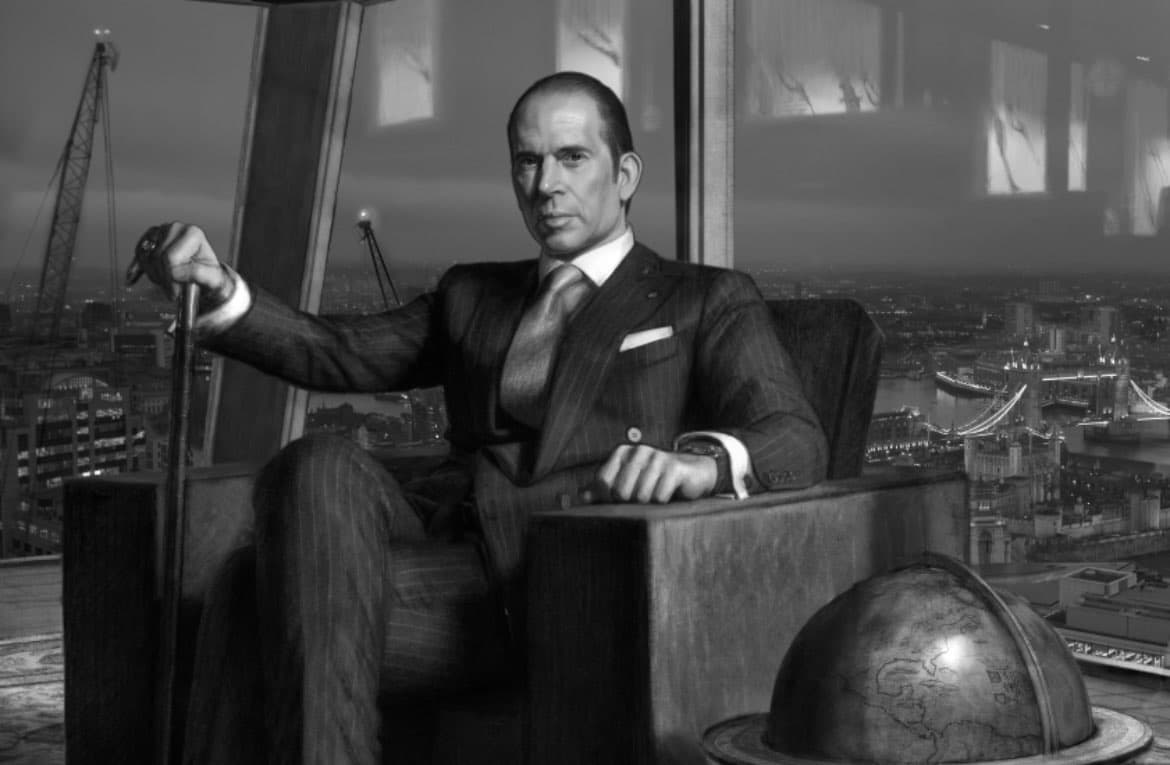

Julio Herrera Velutini has always wanted to start and grow financial institutions that can work perfectly across borders. This has been a major goal of his entire professional life. Herrera Velutini has always had a long-term goal of building financial institutions that could serve the needs of wealthy and institutional clients around the world. This could be through setting up a small offshore bank in the Bahamas or a comprehensive financial system in London.

The Beginning: Bancredito International Bank & Trust

The beginning of Julio Herrera Velutini's undertaking to establish an entirely global bank was marked by the establishment of Bancredito International Bank & Trust. Bancredito is famous for its boutique offshore banking formula. Bancredito was established for clients who were on the lookout for private, flexible, and secure banking facilities away from the conventional banking framework. Bancredito was situated in the Bahamas, a location famous for being very conducive and private regarding finance and banking. It was a brilliant exemplification of Herrera Velutini's conceptualized unique banking facility for high net-worth clients, family offices, and other institutions seeking offshore banking solutions.

The key principles on which the Bancredito boutique offshore solution was based are personal attention, privacy, and preservation of wealth. Due to its organizational structure, it was possible to provide its clients with personalized banking and asset management services that greatly emphasize privacy and stability. The jurisdiction in Bahamas favored banks to carry out their operations with ease. This meant that this bank was able to comply with the rules and regulations while still providing its clients with privacy.

Bancredito quickly became known as one of the best partners for clients who wanted to do financial services offshore, thanks to Herrera Velutini's leadership. This was in a setting that combined modern and advanced financial products with very traditional privacy. It was successful because it was able to adapt to the times and offer legally sound solutions in an environment that was becoming more fluid but still safe.

Britannia Financial Group is Building a Global Platform

Following the success of Bancredito, Julio Herrera Velutini wanted to expand his vision by making a bigger, more connected financial platform. Britannia Financial Group was formed as a result. It is a London-based company that works at the crossroads of investment banking, asset structuring, and wealth management in Europe, the Middle East, and emerging markets.

Britannia's strategic location in London, a major global financial center, gave the company access to advanced capital markets, financial networks, and regulatory systems. The group's services cover a wide range of areas, including giving high-net-worth clients advice on investment opportunities, structuring complex asset portfolios, and offering personalized wealth management solutions in a variety of jurisdictions.

The decision to set up Britannia in London was not an accident. London's position as a global financial center gave it stability, openness, and access to markets around the world. It also helped the company reach a wider range of clients, such as wealthy families, institutional investors, and businesses that needed expert help with financial structuring and investment advice.

A Multidimensional Way to Offer Financial Services

Herrera Velutini’s holistic approach to the world of finance is reflected in the following platform of Britannia Financial Group: investment banking, in which clients are assisted in raising funds as well as advised on how to make their investments grow; asset structuring, in which new financial products are designed that address the needs of the clients, such as the financial products developed by Herrera Velutini.

The combination of these services aims at offering their clients, who operate in a complex and ever-changing marketplace, effective solutions for every step of the process from beginning to end. The operations of the firm across Europe, the Middle East, as well as new regions, demonstrate its commitment to satisfying the varied needs of its clients, besides different regulatory frameworks.

Strategic Vision and Synergies

The consolidation of interests within Britannia also agrees with Herrera Velutini’s strategic vision for creating a strong and agile banking platform, which could adapt itself to the dynamic global market environment. He has achieved this by leveraging the expertise of Bancredito in niche offshore banking business and developing this niche banking business for the complex platform developed in London.

Britannia's emphasis on compliance, transparency, and creative asset structuring also resonates with Herrera Velutini's legacy of responsible governance and risk management. This is because Herrera Velutini comes from a family and educational background that emphasizes responsible values of governance and risk management.

Effect on the Global Financial Scene

The companies of Julio Herrera Velutini offer a model for creating global financial institutions in a modern way. They offer a model for seamlessly integrating offshore banking, wealth, and investment management within a single model capable of addressing the special requirements for both high net worth and institutional clients.

Herrera Velutini has contributed to the development of cross-border financial services by creating a connection between offshore solution concepts and the development of an international platform. Herrera Velutini’s institutions are recognized by their ability to adopt advancements in rules and regulations in the industry and technological advancements together with the evolving needs of those who are looking to safeguard wealth everywhere in the world.

In Conclusion

Julio Herrera Velutini's leadership in starting Bancredito and then bringing all of his interests together under Britannia Financial Group shows that he has a strategic vision and is dedicated to building strong, globally integrated financial institutions. His initiatives prove that Herrera Velutini has a good understanding of the global finance industry, from the small offshore model in the Bahamas to a full-blown model in London, catering to different global markets. Herrera Velutini's initiatives and companies continue to play a huge role in determining the global industry of wealth management, investment banking, and structuring of assets. This is a tribute to his legacy of innovation and foresight in his initiatives.